The AVECs, a springboard to financial independence

The Associations Villageoises d’Épargne et de Crédit (AVECs) are groups of people who save together and make loans from those savings to invest in small businesses. Annually, the savings accumulated and the profits on the loans are divided equally among all members.

In 2022, we started this system with our partner Eclosio. The goal is to give entrepreneurial men and women more accessible access to financial support to develop their professional activities.

After thorough training, our Foundation’s agricultural counsellors established AVECs in the municipalities of Tchaourou and N’Dali. Today they manage and monitor 15 AVEC groups with 437 members, more than 80% of whom are women.

All AVEC members received training in financial management to better monitor their loans. Each group also has a safe deposit box, a cash book and other materials to keep everything on track. Under the supervision of agricultural counsellors, members meet weekly to collect their savings. The money collected is used to grant loans to members who want to use it to pay for the development of their economic activities and who meet the conditions.

AVECs are particularly interesting to women because they often have difficulty accessing traditional financial services such as banks and even microfinance. Women who are members of an AVEC can become financially independent gradually. They have seen their standard of living improve, enabling them to support their families and care for their children.

From August 2022 to March 2023, the 15 AVECs together saved about 19,000 euros. Loans for about 18,000 euros were granted, and 16,000 euros have already been repaid.

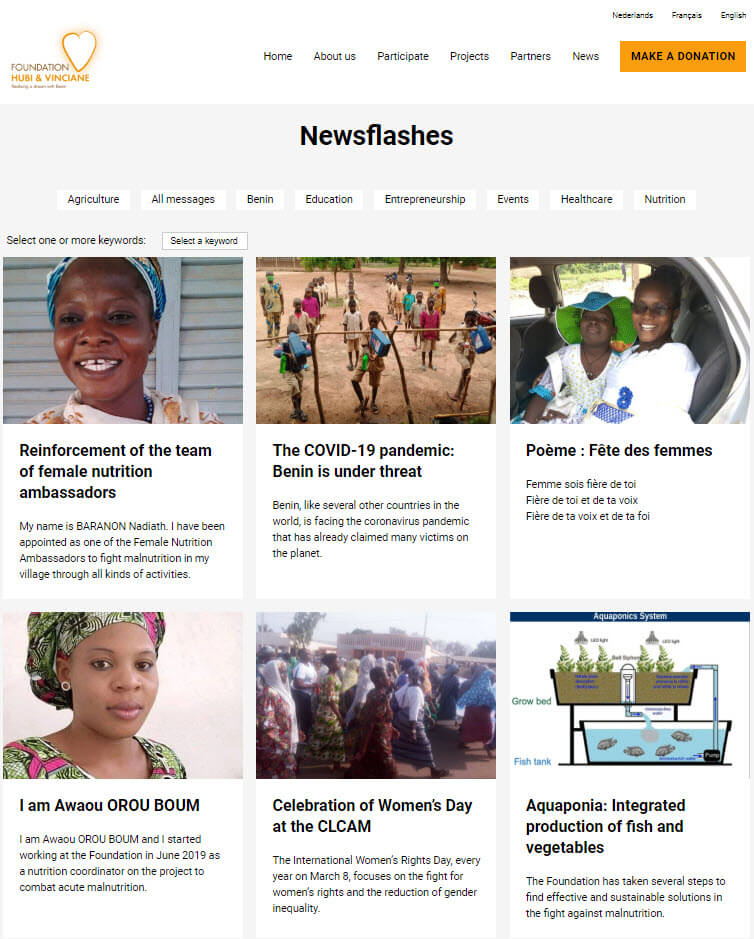

To better understand the benefits and impact of AVECs, we spoke with some women who are members of an AVEC.

Mariam, a member of the AVEC of Tchaourou:

“Thanks to the AVEC, I was able to develop my textile business. I received a small loan to buy more fabrics and increase my income. Now I can take care of my children and pay school fees”.

Fatouma, a member of the AVEC of N’Dali:

“The AVEC changed my life. I learned to save money and manage my finances well. I also got a small loan to expand my vegetable business. Now I have more customers and can make more money.”

Aminata, a member of the AVEC of Tchaourou:

“The AVECs give me and the other women of my community new hope. We have learned to work together and support each other. The AVECs have given women in our community a voice and a place in society.”

AVECs have a positive impact on the lives of women in rural communities. By offering them financial support adapted to their needs, AVECs contribute to their economic emancipation and empowerment.